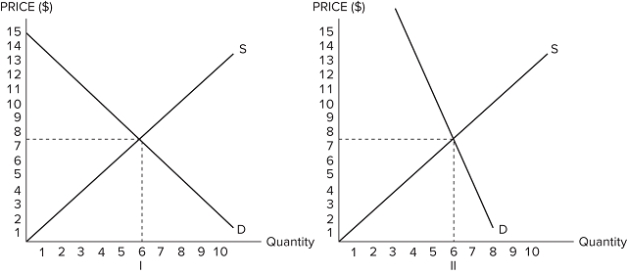

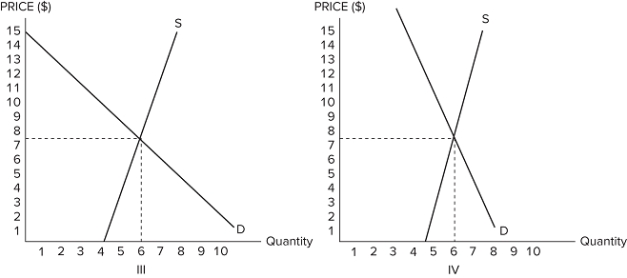

Suppose the government is considering imposing a $6 per unit tax in one of the markets shown in graphs I, II, III, and IV.  <p><b><span style="font-size:20pt;"><span style="color:#FF0000;">

<p><b><span style="font-size:20pt;"><span style="color:#FF0000;">

In which graph would this tax generate the largest revenue?

Definitions:

Job Order Cost System

An accounting system used to assign costs to specific jobs or batches, ideal for customized orders.

Indirect Product Costs

Costs that are not directly traceable to a specific product but are necessary for the production process, such as utilities or managerial salaries.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to products or job orders, based on a set activity measure.

Raw Materials

Basic materials that are used in the production process to manufacture finished goods.

Q8: The graph shown displays a society's Lorenz

Q12: How does the free rider problem affect

Q49: The net increase to total surplus when

Q52: Entitlement spending:<br>A)is public expenditure that is mandated

Q53: Raising cattle causes negative externalities in the

Q71: Joanna is shopping online at one of

Q105: Which of the following programs can be

Q110: Which of the following is considered a

Q111: One of the difficulties the government faces

Q111: Who is affected when a subsidy is