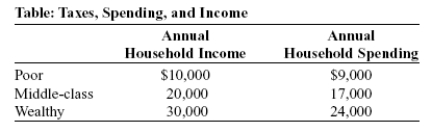

Use the following to answer questions:

-(Table: Taxes, Spending, and Income) Suppose Governor Meridias decides to initiate a state income tax. The first $50,000 of household income is tax-free, while any income above $50,000 is taxed at 10%. The tax rate for a household earning $75,000 is:

Definitions:

Tax Revenues

The income that is received by the government from taxation.

Progressive Taxation

A tax system where the tax rate increases as the taxable amount or income increases, aiming to distribute the tax burden more equitably among individuals.

Marginal Tax Rate

The percentage of tax applied to your income for each additional dollar of income, essentially the tax rate on the last dollar earned.

Total Tax Rate

The combined rate of all the taxes that an individual or business is liable to pay, expressed as a percentage of income.

Q26: (Figure: The Market for Tea in Sri

Q78: The price elasticity of demand for ground

Q121: If quantity supplied responds substantially to a

Q136: Tax incidence refers to:<br>A) who writes the

Q142: (Figure: The Market for Tea in Sri

Q164: If you wanted to make sure that

Q197: The United States can produce 30 computers

Q228: (Figure: A Tariff on Oranges in South

Q245: Many countries engage in trade protection by

Q254: If the price elasticity of demand between