Use the following to answer questions:

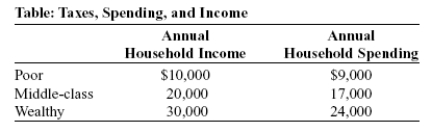

-(Table: Taxes, Spending, and Income) Suppose Governor Meridias initiates a tax of 10% on all income up to $50,000. Income above $50,000 is not taxed. An individual earning $75,000 will have an average tax rate of:

Definitions:

Direct Labour Hours

The total hours worked by employees directly involved in the manufacturing process, contributing to the transformation of raw materials into finished goods.

Unfavourable Variance

A financial term indicating that actual results are worse than expected or budgeted results, leading to a negative impact on profitability.

Sales Volume Variance

A metric used in budgeting and accounting to measure the difference between the actual quantity sold and the expected sales volume, indicating the impact on profit.

Variable Costing

An accounting method that only includes variable production costs (materials, labor, and variable overhead) in product costs and treats fixed overhead as a period expense.

Q17: Taken collectively, people in nations that engage

Q35: Suppose Governor Meridias decides to initiate a

Q39: A price ceiling will have NO effect

Q52: U.S. federal taxes are generally _, while

Q75: The most likely reason that the government

Q112: Rapidly increasing health costs have been a

Q159: (Table: The Market for Fried Twinkies) Look

Q213: (Table: Production Possibilities for Machinery and Petroleum)

Q229: A tax of $10 on an income

Q231: (Figure: Domestic Market for Digital Cameras) Look