Use the following to answer questions:

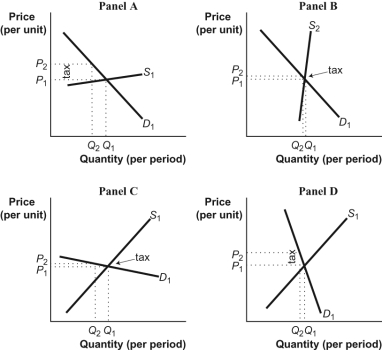

Figure: Tax Incidence

-(Figure: Tax Incidence) Look at the figure Tax Incidence. All other things unchanged, the effect of an excise tax on gasoline in the long run is most likely illustrated by panel _____, and the greater share of the burden of the excise tax (shown by the tax wedge in each panel) is borne by _____.

Definitions:

Section 5

Could refer to a specific part of a law or statute, needing further context to accurately define; generally, it's used to denote a particular subsection of legal documentation.

FTC Act

The Federal Trade Commission Act, a law that established the FTC and aims to prevent unfair competition, and deceptive or unfair business practices.

Deception

The act of misleading or concealing the truth to manipulate or cheat, which can be both socially and legally punishable.

Magnuson-Moss Act

A federal law enacted in 1975 aimed at improving consumer protections and warranties on household products and automobiles.

Q15: If the government levies an excise tax

Q66: Suppose Congress passed a new tax system,

Q72: The _ analyzes trade under the assumption

Q81: (Table: The Production Possibilities for Tractors and

Q81: An excise tax that the government collects

Q117: (Figure: Demand for Notebook Computers) Look at

Q144: If quota rents do not accrue to

Q220: France and England both produce wine and

Q262: FICA taxes are considered to be:<br>A) proportional.<br>B)

Q297: (Table: Taxes, Spending, and Income) Look at