Use the following to answer questions:

Scenario: Linear Production Possibility Frontier

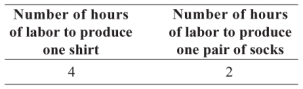

Largetown has a linear production possibility frontier, and it produces socks and shirts with 80 hours of labor. The table shows the number of hours of labor necessary to produce one pair of socks or one shirt.

-(Scenario: Linear Production Possibility Frontier) Look at the scenario Linear Production Possibility Frontier. If Largetown's labor resource decreases by 40 hours, the opportunity cost of producing shirts:

Definitions:

Loan Fees

Charges associated with the origination, maintenance, or closure of a loan, ranging from application fees to prepayment penalties.

Deductible

An expense that can be subtracted from gross income to reduce taxable income.

Schedule A

Schedule A is a form attached to the US individual income tax return used to itemize deductions such as medical expenses, property taxes, and charitable contributions.

Charitable Contributions

Contributions given to eligible entities that the donor might deduct from their taxes.

Q32: In 2012, which of the following demographic

Q56: (Table: Production Possibilities Schedule II) Look at

Q107: When some people know things that other

Q121: You insure your car against theft. Consequently,

Q137: (Table: Wages and Hours Willing to Work)

Q189: If an insurance company insured 100,000 cars

Q206: All points on the production possibility frontier

Q251: Kurt earns a wage of $100 per

Q298: A firm's demand curve for labor is:<br>A)

Q347: According to the marginal productivity theory of