Use the following to answer questions:

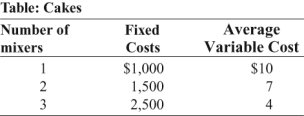

-(Table: Cakes) Look at the table Cakes. Pat is opening a bakery to make and sell special birthday cakes. Her estimated fixed and average variable costs if she purchases one, two, or three mixers are shown in the table. Assume that average variable costs do not vary with the quantity of output. Suppose that Pat used to produce 100 cakes, but she has a sudden increase in demand, so that she begins to produce 200 cakes. Explain how her average total cost will change in the short run and in the long run.

Definitions:

Contribution Margin

The amount remaining from sales revenue after variable costs have been deducted, indicating how much revenue is contributing to covering fixed costs and generating profit.

Income Statement

A financial statement that reports a company's financial performance over a specific accounting period, detailing revenues and expenses.

Expenses

Outflows or depletions of assets or incurrences of liabilities during a period as a result of delivering or producing goods, rendering services, or carrying out other activities linked to an entity's main operations.

Variable Costing

A costing method where variable manufacturing costs are treated as product costs, and fixed manufacturing overhead is treated as a period cost.

Q49: If two firms are identical in all

Q77: When marginal cost is ABOVE average variable

Q111: If ATC is equal to MC, then

Q141: Janella consumes only bananas and passion fruit.

Q159: Some people say, "There are too many

Q162: Max consumes only yogurt and almonds, and

Q178: A new startup airline is offering free

Q339: Ms. Sweettooth always consumes iced tea and

Q347: (Table: Consumer Equilibrium) Look at the table

Q353: (Table: Tonya's Production Function for Apples) Look