Use the following information and graph to answer the question.

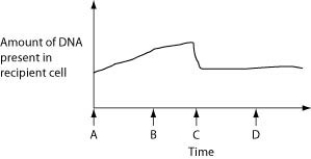

The figure below depicts changes to the amount of DNA present in a recipient cell that is engaged in conjugation with an Hfr cell. Hfr cell DNA begins entering the recipient cell at Time A. Assume that reciprocal crossing over occurs (in other words, a fragment of the recipient's chromosome is exchanged for a homologous fragment from the Hfr cell's DNA) .

During which two times can the recipient accurately be described as "recombinant" due to the sequence of events portrayed in the figure?

Definitions:

Employment-Related Expenses

Costs incurred by employees during the course of their job that are necessary and not reimbursed by the employer, possibly deductible under certain conditions.

Joint Taxpayer

Two individuals, usually married, who file a single tax return together, combining their incomes and sharing deductions.

Education Credit Deduction

A type of deduction that allows eligible taxpayers to subtract education expenses from their taxable income, enhancing affordability for higher education.

Dependent

An individual, usually a child or spouse, who relies on another person (typically a family member) for financial support and qualifies for certain tax benefits on that person’s tax return.

Q8: Fungi have an extremely high surface-to-volume ratio.

Q14: Use the following information to answer the

Q28: In recent times, it has been shown

Q38: Which of the following could occur only

Q45: Concerning growth in genome size over evolutionary

Q48: If one were to propose a new

Q50: The duplication of homeotic (Hox)genes has been

Q63: Use the following information and graph to

Q74: Use the following information to answer the

Q75: Use the following information and figure to