Use the following information and figure to answer the question.

The sea slug Pteraeolidia ianthina (P. ianthina) can harbor living dinoflagellates (photosynthetic protists) in its skin. These endosymbiotic dinoflagellates reproduce quickly enough to maintain their populations. Low populations of the dinoflagellates do not affect the sea slugs very much, but high populations (> 5 x 10⁵ cells/mg of sea slug protein) can promote sea slug survival.

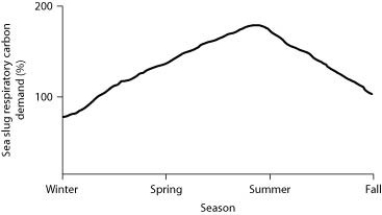

Percent of sea slug respiratory carbon demand provided by indwelling dinoflagellates.

Which of the following would be a potential disadvantage to the sea slugs of housing the dinoflagellates?

Definitions:

Company Tax Rate

is the percentage of their profits that businesses are required to pay to the government as tax, which can vary based on the jurisdiction and the specific laws applicable to the company's operations.

Tax Base

The amount that is attributed to an asset or liability for tax purposes.

Tax Purposes

For tax purposes refers to the considerations and rules applied in the calculation and reporting of taxes owed or refunds due to governing tax authorities.

Current Tax Liability

The amount of income taxes a company expects to pay within the current year, based on its taxable income.

Q13: Use the information in the following paragraph

Q36: Which of the following statements correctly describes

Q41: Which of the following problems will likely

Q43: Which of the following pairs are the

Q47: In a hypothetical environment, fishes called pike-cichlids

Q51: Use the information to answer the following

Q56: Use the following description and table

Q66: What adaptations should one expect of the

Q68: Use the following information to answer the

Q71: Use the information to answer the following