Use the table below to answer the following question(s) .

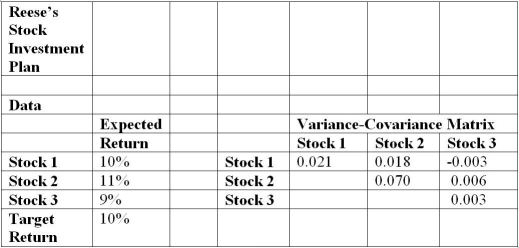

Jonathan Reese is considering three stocks in which to invest with a fixed budget.The table below provides information on Jonathan's expected returns for each stock.The table also provides information, collected from market researchers, on the variance-covariance matrix of the individual stocks.He expects a total return of at least 10%.

Develop a quadratic optimization model to find the optimal allocation of the budget to each stock, and variance calculations for squared terms and cross-products based on the variance-covariance matrix.

-According to the model, what is the squared term value for Stock 2 variance?

Definitions:

Incorporation Process

The legal procedure by which a business entity is formed as a corporation, involving registration with the state, drafting articles of incorporation, and meeting other regulatory requirements.

Capital

Financial assets or the financial value of assets, such as cash or goods, used by a company to fund its operations and facilitate its growth.

Double Taxation

The imposition of tax by two or more jurisdictions on the same declared income, asset, or financial transaction.

S Corporation

A type of corporation in the United States that elects to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code, allowing profits to be passed directly to shareholders and avoid double taxation.

Q1: During the electron transport process, protons and

Q4: According to the linear optimization model, what

Q16: Which of the following Excel functions is

Q20: Explain econometric models used in forecasting with

Q29: What is the mean absolute deviation obtained

Q44: A(n)_ is a matrix whose rows correspond

Q53: According to the nonlinear model, which of

Q61: According to the linear optimization model, what

Q69: Transcription in eukaryotes occurs in the<br>A) RNA

Q74: Which element functions BOTH as an enzyme