Use the table below to answer the following question(s) .

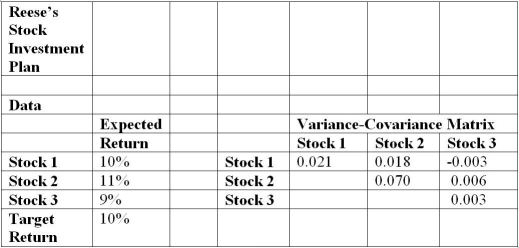

Jonathan Reese is considering three stocks in which to invest with a fixed budget.The table below provides information on Jonathan's expected returns for each stock.The table also provides information, collected from market researchers, on the variance-covariance matrix of the individual stocks.He expects a total return of at least 10%.

Develop a quadratic optimization model to find the optimal allocation of the budget to each stock, and variance calculations for squared terms and cross-products based on the variance-covariance matrix.

-According to the model, what is the squared term value for Stock 3 variance?

Definitions:

Main Bank Account

The primary checking or savings account used by an individual or business for managing their daily financial transactions and cash flow.

Multiple Accounts

Refers to having more than one account, often in financial or online contexts, to manage different aspects.

Disbursement Float

The time delay between when a check is written and when it is actually deducted from the payer's account.

Available Balance

The funds in a bank account that are accessible for withdrawal or use, accounting for any pending transactions.

Q2: According to the model, what is the

Q4: According to the linear optimization model, what

Q9: What is the expected value of perfect

Q10: If an oxidation reaction occurs<br>A) simultaneous reduction

Q15: During electron transport reactions<br>A) OH⁻ accumulates on

Q21: What is the expected loss determined from

Q30: When counting colonies on an agar plate<br>A)

Q41: Proteins known as chaperones are found only

Q43: List out the different types of constraints

Q63: How does a tornado chart help make