Use the table below to answer the following question(s) .

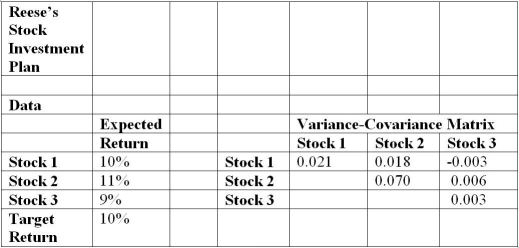

Jonathan Reese is considering three stocks in which to invest with a fixed budget.The table below provides information on Jonathan's expected returns for each stock.The table also provides information, collected from market researchers, on the variance-covariance matrix of the individual stocks.He expects a total return of at least 10%.

Develop a quadratic optimization model to find the optimal allocation of the budget to each stock, and variance calculations for squared terms and cross-products based on the variance-covariance matrix.

-According to the model, what is the cross-product value for Stock 3 variance?

Definitions:

Short Sell

The practice of selling a borrowed security with the intention of buying it back later at a lower price to profit from the price difference.

Arbitrage Pricing Theory

A financial model that estimates the return of an asset by considering multiple risk factors and their respective risk premiums, excluding unsystematic risk through diversification.

Nonsystematic Risk

The risk associated with a specific issuer of a security, also known as idiosyncratic or unsystematic risk, that can be reduced through diversification.

Well-Diversified Portfolio

An investment portfolio that includes a mix of assets (e.g., stocks, bonds, real estate) to reduce risk through diversification.

Q8: What is the value of safety stock?<br>A)45<br>B)71<br>C)120<br>D)95

Q22: From the "what if" values, calculate the

Q26: The formation of new DNA does NOT

Q27: What are the three elements required to

Q41: Cellular inclusions in prokaryotic cells serve to<br>A)

Q42: Interaction is:<br>A)the principle of having a model

Q56: Most microorganisms are pathogenic.

Q56: According to the nonlinear model, which of

Q69: Describe two capabilities of microbes that exemplify

Q74: What temperature is most commonly used in