Use the table below to answer the following question(s) .

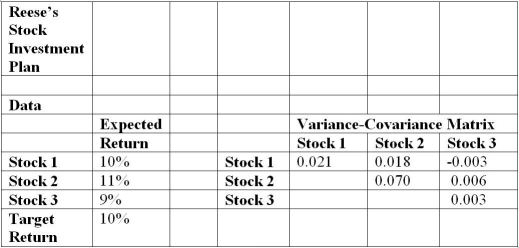

Jonathan Reese is considering three stocks in which to invest with a fixed budget.The table below provides information on Jonathan's expected returns for each stock.The table also provides information, collected from market researchers, on the variance-covariance matrix of the individual stocks.He expects a total return of at least 10%.

Develop a quadratic optimization model to find the optimal allocation of the budget to each stock, and variance calculations for squared terms and cross-products based on the variance-covariance matrix.

-According to the model, what is the cross-product value for Stock 1 variance?

Definitions:

Stratified Random Sample

A sampling method where the population is divided into subsets, known as strata, and a random sample is taken from each stratum.

Freshman

A student in their first year of study at a high school or university.

Sophomore

The term used to describe a second-year student in high school or college.

Junior

A term typically used to describe a third-year student in a four-year educational institution or someone with intermediate level experience in a job role.

Q8: The strength of the association rule, known

Q15: For a two-sample test, explain the procedure

Q20: Explain econometric models used in forecasting with

Q23: What is the relationship between the age

Q25: In a curvilinear regression model, the _

Q34: Why is it incorrect to say that

Q42: _ is a data-mining technique used for

Q43: From the "what if" values, calculate the

Q50: Indicators are measures that are believed to

Q83: The membrane of a gas vesicle is