Use the table below to answer the following question(s) .

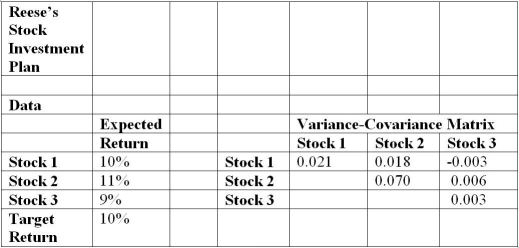

Jonathan Reese is considering three stocks in which to invest with a fixed budget.The table below provides information on Jonathan's expected returns for each stock.The table also provides information, collected from market researchers, on the variance-covariance matrix of the individual stocks.He expects a total return of at least 10%.

Develop a quadratic optimization model to find the optimal allocation of the budget to each stock, and variance calculations for squared terms and cross-products based on the variance-covariance matrix.

-According to the model, what is the expected total return on all stocks?

Definitions:

Enslavement

The act of making someone a slave or the state of being held as a slave, depriving them of personal freedom.

Inter-Tribal Competition

Rivalry or conflict between different Native American tribes, which could involve battles over resources, territory, or political dominance.

Mining Rights

Legal entitlements granting individuals or corporations the permission to extract minerals from the ground within a specified area.

Indian Cultural Habits

Practices and rituals that are part of the daily life in India, influenced by religion, tradition, and historical context, including cuisine, festivals, and familial structures.

Q2: If the Euclidean distance were to be

Q4: During a study, individuals were asked

Q16: Louis Pasteur's most famous success was his

Q19: What is the total amount of cash

Q21: Using the data, determine the value of

Q23: The effectiveness of a classification rule can

Q25: Activation energy is the energy<br>A) required for

Q36: What is the average daily sale during

Q37: What is the value of standard deviation

Q44: Magnesium is not considered a growth factor