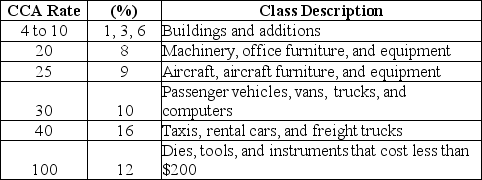

Sample CCA Rates and Classes are presented as follows:  What does the number "20" in the CCA Rate column mean?

What does the number "20" in the CCA Rate column mean?

Definitions:

Segmented Income Statement

An income statement broken down into segments, such as product lines or geographical areas, to analyze profitability.

Absorption Costing

An accounting technique that assigns the total manufacturing costs, including direct materials, direct labor, and both kinds of manufacturing overhead (fixed and variable), to a product’s cost.

Gross Margin

The difference between sales revenue and cost of goods sold, expressed as a percentage of sales revenue, indicating the financial health and profitability of a business.

Absorption Costing

An approach to costing that encompasses all costs associated with manufacturing, including direct materials, direct labor, as well as variable and fixed manufacturing overheads, in the product cost.

Q5: In order to make a replacement decision

Q7: What does the exclusionary rule provide?

Q11: Which of the following is viewed as

Q17: The _ in most states is required

Q23: "Although it goes without saying that all

Q38: A company invested $3.5 million in a

Q41: Police are required to corroborate at least

Q61: In which of the following cases did

Q72: Which of the following follows the pretrial?<br>A)appeal<br>B)postconviction<br>C)arraignment<br>D)pretrial

Q77: What is the presumption of regularity?