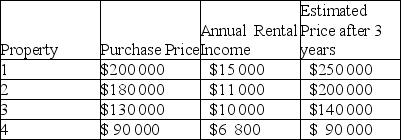

An investor has the following properties to invest in over a period of three years and uses a MARR of 9%:

Using incremental IRR, which property, if any, should she invest in?

Using incremental IRR, which property, if any, should she invest in?

Definitions:

Quick Assets

Assets that can be quickly converted into cash without a significant loss in value, including cash, marketable securities, and accounts receivable.

Current Liabilities

Obligations or debts that a company must pay within one year or within its operating cycle if longer.

Gross Margin Ratio

A financial ratio that measures a company's financial health, calculated by subtracting the cost of goods sold from net sales and dividing by net sales.

Sales Revenue

The total amount of money received by a company from sales of goods or services before any expenses are subtracted.

Q1: Your company recently constructed a steel mill

Q2: A firm decides to invest $5 million

Q7: The ability to discriminate differences among the

Q17: You are trying to estimate the annual

Q41: Stan bought a car three years ago

Q44: The conventional benefit-cost ratio of a public

Q44: As a rule, each project includes a

Q44: The term "deciduous teeth" refers to_.<br>A) a

Q63: The Croesus Trust Fund currently has $1

Q64: Suppose that the nominal interest rate is