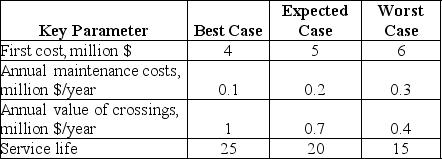

MMM Consulting is considering three scenarios of building a bridge. Data collected by the firm's experts are presented below:

Probability of the best case scenario is 10% while probability of the expected and the worst case scenarios is 70% and 20% respectively. Assuming zero inflation and 10% annual interest rate, should the bridge be built?

Probability of the best case scenario is 10% while probability of the expected and the worst case scenarios is 70% and 20% respectively. Assuming zero inflation and 10% annual interest rate, should the bridge be built?

Definitions:

Net Income

The overall income a company retains following the subtraction of all costs and tax obligations from its earnings.

Net Cash Inflows

The total amount of cash received minus the total amount of cash outflows over a specified period.

Operating Income

Operating income is the profit earned from a firm's normal business operations, excluding non-operating income and expenses like interest and taxes.

Cash Payback Period

The duration it takes for an investment to generate cash flows sufficient to recover the initial investment cost, often used in capital budgeting to assess investment attractiveness.

Q11: A factory produces two million hand-held computers

Q12: In this question, you are to write

Q26: Regression is a form of developmental delay.

Q28: When an engineer prepares a feasibility study,

Q31: What is the difference between market value

Q31: Twelve-year-olds exhibit an increased sense of _

Q35: Evaluation of an engineering project involves the

Q37: Puts spoon in bowl<br>A)Autonomy<br>B)Crossing the midline<br>C)Early toddler

Q42: What is judicial review?

Q47: Most typically developing infants are able to