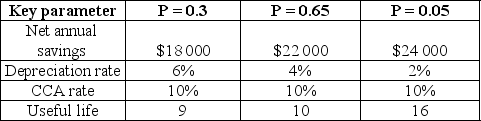

The Kisu Company has just spent $100 000 to install a new technological line to produce kitchen knives. Estimates and probabilities for net annual savings, depreciation rates, CCA rates and useful life are given below:

Kisu pays a 30% corporate tax rate. Calculate the expected value of the annual worth of the line if the after-tax MARR is 10%.

Kisu pays a 30% corporate tax rate. Calculate the expected value of the annual worth of the line if the after-tax MARR is 10%.

Definitions:

Liquidation

The process of closing a business, selling its assets, and using the proceeds to pay creditors, with any leftovers distributed to shareholders.

Measurement Base

The method or approach used in determining the value of assets and liabilities for accounting and reporting purposes.

Present Value

The current worth of a future sum of money or stream of cash flows, given a specified rate of return. Present value considers the time value of money.

Discounted Future

Refers to the process of estimating the present value of an expected future cash flow by applying a discount rate to account for the time value of money.

Q8: What is the undepreciated capital cost and

Q17: Friendships are extremely stable and long-lasting once

Q19: For a given firm, the balance sheet<br>A)summarizes

Q20: Annual inflation is expected to be 3.5%

Q30: What is contingent valuation?<br>A)assigning a value to

Q31: You want to have a million dollars

Q36: Logical thinking involves reasoning that is based

Q42: NB Power wants to assess the opportunity

Q44: The _ reflex can be triggered by

Q47: Suppose there are two mutually exclusive public