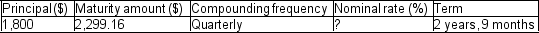

Calculate nominal rate of interest (to the nearest 0.01%):

Definitions:

Tax Tables

Tax tables are charts provided by tax authorities that display tax rates and brackets to help taxpayers determine their tax liabilities.

Married Couple

A legal union between two individuals recognized by law, often entailing specific rights, responsibilities, and benefits under the tax code.

Personal Exemption

A deduction that allowed taxpayers to reduce taxable income for themselves and for any dependents claimed, notably reduced to $0 for tax years 2018 through 2025 under the Tax Cuts and Jobs Act.

Qualifying Relative

A designated family member or other individual who meets specific IRS criteria for dependency exemptions.

Q7: Dakota intends to save for occasional major

Q16: Two payments of $5,000 are scheduled six

Q19: ABC Ltd. reports that its sales are

Q89: In early 2013, the Templeton Growth Fund

Q98: A conditional sale contract requires two payments

Q153: A few years ago, Larissa invested $1500

Q166: Calculate nominal rate of interest (to the

Q211: If Kelly can make monthly payments of

Q218: A Province of Ontario bond has 14½

Q309: Calculate the missing interest rate (to the