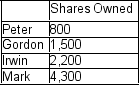

Peter, Gordon, Irwin and Mark are currently in a partnership. However, Peter is retiring and will be bought out by the remaining three partners for $150,000. The current ownership structure is as follows:

If Gordon, Irwin and Mark still wish to maintain the same ownership percentage, how should Peter's shares be allocated?

If Gordon, Irwin and Mark still wish to maintain the same ownership percentage, how should Peter's shares be allocated?

Definitions:

Dividends

A company's profit-sharing with its investors, generally executed through financial payments.

Net Income

The net income of a company once all costs, taxes, and losses have been deducted.

Partial Equity Method

An accounting technique used when a company has significant influence over another company but does not control it outright, recognizing income to the extent dividends are received.

Net Income

The total earnings of a company after subtracting all expenses and taxes from total revenue.

Q16: A product costing $350, less 30%, 20%,

Q61: The payment terms on a $2,433 invoice

Q66: In the second year

Q71: Is it possible for the rate of

Q72: Using the exchange rates in Table 3.2,

Q85: A wholesaler offers discounts of 10%, 8%,

Q127: Solve for x and y in the

Q216: A caterer has the following price structure

Q255: Express the following ratio in its

Q358: Simplify: (n<sup>0.5</sup>)<sup>8+</sup>