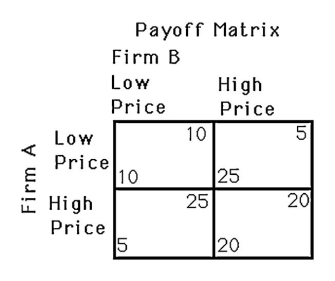

-The above figure shows a payoff matrix for two firms,A and B,that must choose between a high-price strategy and a low-price strategy.For firm B,

Definitions:

Commercial Bank Reserves

Funds that commercial banks are required to hold in reserve against deposits, either as cash in their vaults or as deposits with the central bank.

Reserve Ratio

The portion of depositors' balances that banks must have on hand as cash, as required by central banking regulations.

Discount Rate

The interest rate charged to commercial banks and other financial institutions for the loans they take from the central bank or Federal Reserve.

Depository Institutions Deregulation

This involves removing or loosening government restrictions on banks and other financial institutions to allow for greater efficiency and competition.

Q2: The above figure shows Bob's utility function.

Q7: The expected utility theory<br>A)predicts all actions involving

Q30: A major corporation hires high school students

Q39: A trigger strategy<br>A)is always a dominant strategy.<br>B)is

Q64: Suppose that market demand can be represented

Q79: Explain why insurance companies usually do not

Q84: In the presence of a negative externality

Q97: Recent research suggests that if Apple switched

Q98: The existence of externalities is due mainly

Q106: If the inverse demand function for a