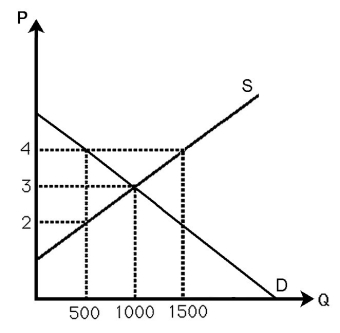

-The above figure shows the demand and supply curves in the market for milk.Currently,the market is in equilibrium.If the government imposes a $2 per gallon tax to be collected from sellers,calculate the dead weight loss associated with the tax,and explain why the dead weight loss occurs.

Definitions:

Taxable Income

The amount of an individual’s or corporation's income used to calculate how much tax they owe to the government, after deductions and exemptions.

Price Elasticities

Measures of the sensitivity of the quantity demanded or supplied of a good to a change in its price.

Tax Burden

The measure of the total amount of taxes that individuals, businesses, or other entities must pay relative to their income or consumption.

Elastic Supply

characterizes a market situation where the quantity supplied changes significantly in response to changes in price.

Q2: All the supply of peppermint oil is

Q2: A firm's advertising can help rivals<br>A)if it

Q5: Joe and Rita each have some milk

Q7: The services of real estate brokers are

Q26: A firm will increase its spending on

Q41: Employing a fixed-weight index like the Consumer

Q56: What is one reason consumers might demand

Q64: Moving away from the contract curve will<br>A)harm

Q135: Economists claim that measuring society's welfare as

Q151: The services of real estate brokers are