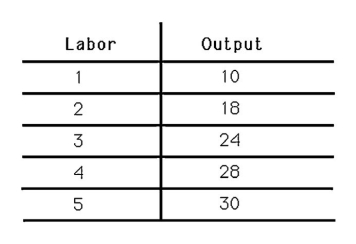

-The above figure shows the short-run production function for Albert's Pretzels.The marginal productivity of labor for the third worker is

Definitions:

Marginal Tax Rates

Marginal tax rates are the rates of tax applied to the next dollar of income, used to determine the tax impact of additional income or deductions.

Total Tax

The sum of all taxes levied on an individual or a corporation by various governmental agencies.

Provincial Tax Brackets

These refer to the range of income segments taxed at different rates by provincial governments in countries like Canada, where taxation powers are shared between federal and provincial authorities.

Net Working Capital

The difference between a company’s current assets and its current liabilities, indicating the liquidity of the business.

Q20: In response to an increase in the

Q37: If a market is controlled by one

Q44: If the price of orange juice rises

Q68: If a consumer's budget line for food

Q75: An increase in the demand curve for

Q89: An increase in unearned income always creates

Q89: A market is perfectly competitive even if

Q94: What is the elasticity of residual supply

Q119: The "Got Milk?" advertising campaign is a

Q125: In the long-run equilibrium in perfect competition,<br>A)producer