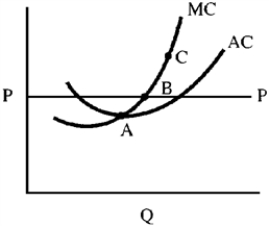

Figure 10-7

-In the long run, the perfectly competitive firm in Figure 10-8 will leave the industry if the price falls below

Definitions:

Initial Yield

The initial yield is a financial measure indicating the first year's return on an investment in real estate or bonds, often expressed as a percentage of the investment's cost.

Yield Sensitivity

The degree to which the price of a bond or other debt security responds to changes in interest rates, affecting investors' returns.

Price Volatility

Price Volatility describes the extent to which the price of an asset or security fluctuates over time, indicating the level of risk involved.

Maturity

Refers to the final payment date of a loan or other financial instrument, at which point the principal (and all remaining interest) is due to be paid.

Q14: "As long as total revenue slopes up,

Q20: To understand most of today's economic activity

Q42: Perfectly competitive markets have absolutely no drawbacks.

Q47: Natural monopolies are of theoretical, but not

Q79: Which of the following is true if

Q101: Corporations produce most of the output in

Q113: A duopoly is<br>A) a cartel in which

Q120: What is true for monopoly that is

Q145: The marginal revenue curve for a monopolist

Q192: Assume that a firm has measured demand