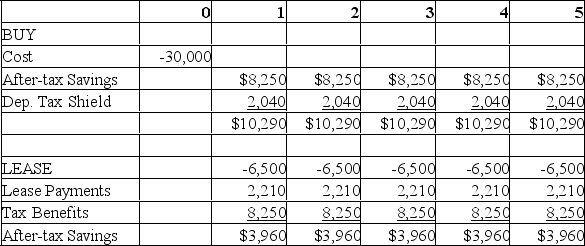

The Blank Button Company is considering the purchase of a new machine for $30,000. The machine is expected to save the firm $13,750 per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $6,500 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 34%, and its cost of debt is 10%.

Calculate the NPV of the lease versus the purchase decision.

Definitions:

Selling Price

The amount at which an item or service is sold to the customer.

Outstanding Balance

The amount of money owed on a loan or credit account that has not yet been repaid.

Invoice

A document indicating a transaction between a buyer and a seller, listing the goods or services provided along with their prices and the total amount due.

EOM

EOM stands for "End of Month," a term used in various contexts, notably in business and finance, to indicate something that occurs or is due at the conclusion of the calendar month.

Q5: Ima Greedy, the CFO of Financial Saving

Q8: What is indenture?

Q10: A firm with high operating leverage is

Q13: In percentage terms, higher coupon bonds experience

Q13: The capital structure chosen by a firm

Q14: A financial institution can hedge its interest

Q25: A lease with high payments early in

Q31: Which of the following is not one

Q45: The main difference between a forward contract

Q46: Ritter's study of Initial Public Offerings (IPOs)