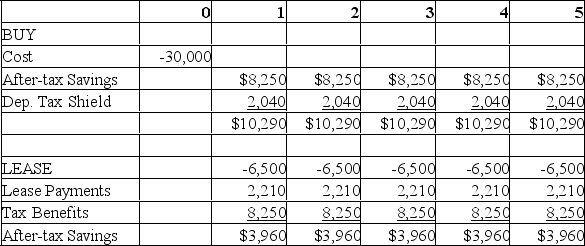

The Blank Button Company is considering the purchase of a new machine for $30,000. The machine is expected to save the firm $13,750 per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $6,500 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 34%, and its cost of debt is 10%.

Calculate the NPV of the lease versus the purchase decision.

Definitions:

Drug Addiction

A chronic disorder characterized by compulsive drug seeking and use, leading to significant brain changes and behavioral consequences despite harmful effects.

Botulin Toxin

A neurotoxic protein produced by the bacterium Clostridium botulinum, which causes botulism and is used medically to treat various conditions, including muscle spasms.

Spoiled Food

Food that has become unsafe or unpalatable due to bacterial growth, chemical breakdown, or other processes that lead to deterioration.

Neurohormones

Chemicals produced and released by neurons that communicate with and regulate other cells, acting similarly to hormones.

Q3: The volatility of interest rates affect the

Q12: Ima Greedy, the CFO of Financial Saving

Q18: If the firm issues debt but writes

Q21: Which of the following is not true

Q22: A firm has 100 shares of stock

Q25: Which of the following is the opposite

Q27: Kelly Industries is given the opportunity to

Q31: An acquisition may take place because of

Q37: A convertible bond is selling for $993.

Q49: The written agreement between a corporation and