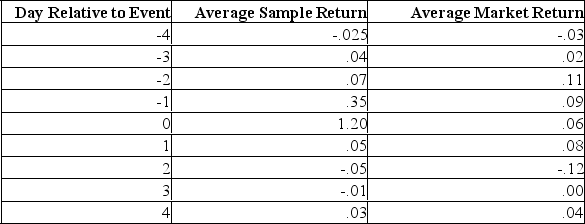

You have observed an apparent, yet odd, increase stock prices when companies have spun-off divisions. You have just collected the data on 50 such events. The average beta (market value weighted) is 1.15 for this group.

Definitions:

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is actually true, commonly denoted by alpha (α) and used to measure the strength of evidence against the null hypothesis.

α

Typically represents the level of significance in hypothesis testing, indicating the probability of rejecting the null hypothesis when it is actually true.

β Recalculate

A statistical process of re-estimating the beta coefficient in finance or regression models, adjusting for changes in variables or data.

Type II Error

A statistical error that occurs when a false null hypothesis is not rejected, meaning a real effect or difference is missed.

Q4: The all equity cost of capital for

Q8: Tina is able to pay $160 a

Q15: If the quoted dividend yield in the

Q21: If a firm is unlevered and has

Q23: A $25 investment produces $27.50 at the

Q24: The Nu-Tux Seat Company has an expansion

Q37: On the date of record the stock

Q40: The unexpected return on a security, U,

Q44: Issuing debt instead of new equity in

Q46: Ritter's study of Initial Public Offerings (IPOs)