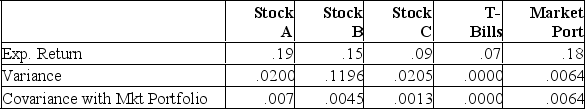

Given the following information on 3 stocks:

Using the CAPM, calculate the expected return for Stock's A, B, and

Using the CAPM, calculate the expected return for Stock's A, B, and

C. Which stocks would you recommend purchasing?

BA = .0070/.0064 = 1.094; ra = .07 + (.18-.07)1.094 = .1903

BB = .0045/.0064 = 0.703; rb = .07 + (.18-.07)0.703 = .1473

BC = .0013/.0064 = 0.203; rc = .07 + (.18-.07)0.203 = .0923

Indifferent on A as .1903 _.19.

Would buy B as.15 > .1473.

Would not buy C as.09 < .0923.

Definitions:

Severely Disturbed

Refers to individuals with extreme emotional, behavioral, or mental health issues that significantly impair functioning.

Hopelessly Depressed

A state of severe depression where the individual feels an overwhelming sense of despair without hope for improvement.

Deep Brain Stimulation

A neurosurgical procedure that involves implanting electrodes in specific areas of the brain to treat neurological and psychiatric disorders by sending electrical impulses.

Neural Hub

A central point in the brain where different neural pathways connect, integrating and processing information.

Q5: For any individual period the firm cash

Q12: The Rent It Company declared a dividend

Q16: The six components that make up the

Q26: What is its cost of equity if

Q28: Peggy Grey's Cookies has net income of

Q32: If the financial markets are efficient, then

Q32: From the following income statement information, calculate

Q34: The Adept Co. is analyzing a proposed

Q42: For a firm with long-term debt, net

Q56: The standard deviation of a portfolio will