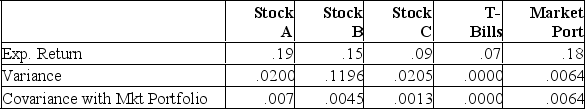

Given the following information on 3 stocks:

Using the CAPM, calculate the expected return for Stock's A, B, and

Using the CAPM, calculate the expected return for Stock's A, B, and

C. Which stocks would you recommend purchasing?

BA = .0070/.0064 = 1.094; ra = .07 + (.18-.07)1.094 = .1903

BB = .0045/.0064 = 0.703; rb = .07 + (.18-.07)0.703 = .1473

BC = .0013/.0064 = 0.203; rc = .07 + (.18-.07)0.203 = .0923

Indifferent on A as .1903 _.19.

Would buy B as.15 > .1473.

Would not buy C as.09 < .0923.

Definitions:

Premature

Occurring or done before the usual or proper time; too early.

Incubator

A device providing controlled environmental conditions for the care and growth of premature babies or the cultivation of microbiological cultures.

Neonatal ICU

A specialized unit within a hospital dedicated to the intensive care of ill or premature newborn infants.

Attachment

An emotional bond between individuals, particularly between a child and caregiver, which is critical for the child's development and psychological security.

Q1: Projected future financial statements are called:<br>A) plug

Q7: If the amount of money to be

Q13: You have an investment opportunity available to

Q25: A project's operating cash flow will increase

Q27: In a portfolio of risky assets

Q28: Capital market history shows us that a

Q34: The average accounting rate of return is

Q40: The Nantucket Nugget is unlevered and is

Q44: A firm has debt of $5,000, equity

Q46: Given the following information, leverage will add