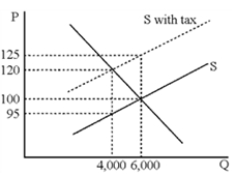

Figure 18-2

-Figure 18-2 shows the widget market before and after an excise tax is imposed.What percentage of the tax per widget is borne by consumers, considering the true economic incidence of the tax?

Definitions:

Stereotypes

Overgeneralized beliefs about a particular category of people, assuming that all members of that category share the same characteristics.

Civil Rights Act

A landmark piece of federal legislation in the United States that outlaws discrimination based on race, color, religion, sex, or national origin, primarily enacted in 1964.

Discriminatory Policies

Practices or directives within organizations that unfairly differentiate between individuals.

Exclusionary Policies

Strategies or practices that deliberately leave out or discriminate against certain groups or individuals from participating or receiving benefits.

Q5: Profits<br>A) are what remains from the selling

Q14: Taxation can promote good social policy while

Q26: A tax that does not change consumers'

Q44: Explain why environmentally minded firms in a

Q66: The demand curve for loanable funds is

Q122: Economists consider environmental pollution to be a(n)<br>A)

Q133: When pollution problems arise from a sudden

Q150: According to the principle of marginal productivity,

Q164: Explain some important situations where direct controls

Q219: The marginal tax rate has less effect