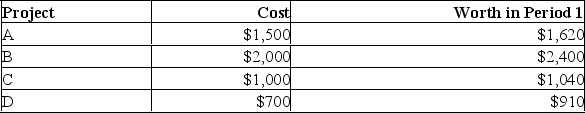

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

An individual has income of $20,000 in period 0 and $42,000 in period 1. An investment opportunity that costs $15,000 in period 0 is worth $18,000 in period 1. The market interest rate is 6%. What is the maximum possible consumption in period 1 if the individual consumes $16,000 in period 0 and follows the NPV rule?

An individual has income of $20,000 in period 0 and $42,000 in period 1. An investment opportunity that costs $15,000 in period 0 is worth $18,000 in period 1. The market interest rate is 6%. What is the maximum possible consumption in period 1 if the individual consumes $16,000 in period 0 and follows the NPV rule?

Definitions:

Minimum Required Rate

The lowest rate of return considered acceptable by investors for investing in a financial instrument, based on risk and alternative opportunities.

Average Operating Assets

An average value of the assets used in the regular operations of a business over a specific period.

Net Operating Income

A measure of a company's profitability, calculated as the difference between its total revenue and operating expenses, excluding taxes and interest.

Return On Investment

A financial ratio used to calculate the profitability of an investment, comparing the gain from an investment relative to its cost.

Q5: A portfolio is entirely invested into Buzz's

Q11: The balance sheet is made up of

Q11: Growth can be reconciled with the goal

Q24: The order in which catch blocks are

Q24: Do you think agency problems arise in

Q26: The payback period rule accepts all investment

Q33: The Expresso Roast Corporation is considering the

Q36: Based on the following information, calculate stockholders

Q41: Marshall's & Co. purchased a corner lot

Q70: Suppose that a bond that will mature