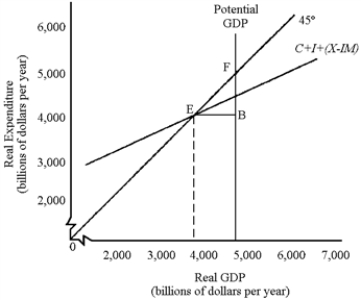

Figure 9-1

-In Figure 9-1,

Definitions:

Tax Bracket

A range of incomes taxed at a particular rate, which forms part of a progressive taxation system where tax rates increase with income.

Cost-Cutting

The process of reducing expenses to improve profitability without compromising the core activities of an organization.

Depreciated Straight-Line

A method of allocating the cost of a tangible asset over its useful life, resulting in a consistent expense amount each period.

Pre-tax Salvage Value

The estimated value of an asset at the end of its useful life before taxes are taken into account.

Q32: In contrast to changes in government spending,

Q38: One complication in the process of reducing

Q47: When computing gross domestic product, government services

Q66: If the federal government increases the amount

Q98: The counterpart to the unsold output of

Q108: If firms are experiencing falling inventories, one

Q154: Stabilization policy may be necessary to slow

Q171: If total spending is less than total

Q206: Productivity increases are most likely to be

Q216: In the United States, the wage rates