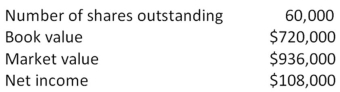

Underwater Experimental is considering a project which requires the purchase of $498,000 of fixed assets.The net present value of the project is $22,500.Equity shares will be issued as the sole means of financing the project.What will the new book value per share be after the project is implemented given the following current information on the firm?

Definitions:

Robert McKersie

A renowned figure in the field of labor relations and negotiations, known for his contributions to the study and practice.

Labor Negotiations

The process in which representatives of workers (usually a union) and employers discuss and agree upon wages, hours, and working conditions.

Theatrical Play

A form of art where a story is enacted on stage by actors performing before an audience, utilizing dialogues, movements, and visual elements.

Public Sector Bargaining

Negotiation processes between government bodies as employers and public sector employees regarding working conditions, salaries, and benefits.

Q1: A project has an accounting break-even point

Q6: You own 15 percent or 13,500 shares

Q21: The intercept point of the security market

Q34: Roger's Store begins each week with 150

Q35: M & M Proposition I with tax

Q47: On July 7, you purchased 500 shares

Q82: Flotation costs for a levered firm should:<br>A)be

Q90: Colors and More is considering replacing the

Q96: Which one of the following is defined

Q99: The Miller-Orr model assumes that:<br>A)the cash balance