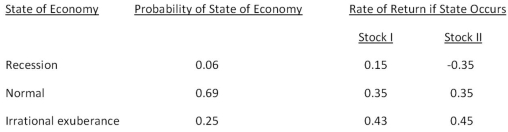

Consider the following information on Stocks I and II:  The market risk premium is 8 percent, and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

The market risk premium is 8 percent, and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

Definitions:

Mortgage

A loan specifically used to purchase real estate, where the property itself serves as collateral for the loan.

Finance Charge

Fees and interest charges associated with the borrowing of money or the extension of credit.

Installments

Periodic payments made towards settling a debt or purchasing a good, spreading out the total cost over a period of time.

Fair Credit Reporting Act

A federal law that regulates the collection, dissemination, and use of consumer credit information to ensure accuracy and privacy.

Q6: Della's Pool Halls has 12,000 shares of

Q11: R.S.Green has 250,000 shares of common stock

Q16: AA Tours is comparing two capital structures

Q32: At an output level of 50,000 units,

Q48: The weighted average cost of capital for

Q49: A 4-year project has an initial asset

Q49: Hungry Hoagie's has identified the following two

Q67: Rossiter Restaurants is analyzing a project that

Q88: What is forecasting risk and why is

Q99: Panelli's is analyzing a project with an