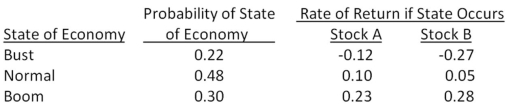

Suppose you observe the following situation:  Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21.What is the expected market risk premium?

Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21.What is the expected market risk premium?

Definitions:

Atlas

The first cervical vertebra of the spine, supporting the globe of the head.

Sacrum

A large, triangular bone at the base of the spine that forms by the fusion of vertebrae, uniting with the pelvis.

Joint Cavity

The space between the articulating surfaces of bones in a synovial joint, filled with synovial fluid that lubricates the joint.

Fibrous Joint

Bones connected by fibrous tissue with no joint cavity; includes sutures, syndesmoses, and gomphoses.

Q4: Bankruptcy:<br>A)creates value for a firm.<br>B)transfers value from

Q15: The expected rate of return on a

Q17: Cantor's has been busy analyzing a new

Q17: Suzie owns five different bonds valued at

Q21: Kurt currently owns 3.4 percent of Northeastern

Q23: Today, you sold 200 shares of Indian

Q40: The costs incurred by a business in

Q62: South Shore Limited has 21,000 shares of

Q68: Purvis Lawn Products has 18,000 shares of

Q68: Atlas Mines has adopted a policy of