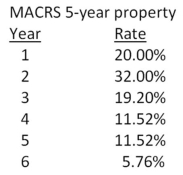

Bernie's Beverages purchased some fixed assets classified as 5-year property for MACRS.The assets cost $94,000.What will the accumulated depreciation be at the end of year three?

Definitions:

Partnership Property

Assets or property owned by a partnership, which are used in the operation of the business and subject to the rights and interests of the partners.

Partner's Interest

A reference to an individual's ownership stake or share in a partnership, reflecting their rights to profits and obligations for losses.

Assignability

The capability of a contractual right or duty to be transferred from one party to another.

Inheritability

The characteristic of a trait, such as property or genetic information, that allows it to be passed down from one generation to the next through inheritance.

Q23: You want to buy a bond from

Q23: Jennifer owns 14,000 shares of Calico Clothing.Currently,

Q55: Marie owns shares of Deltona Productions preferred

Q73: All of the following are related to

Q77: Southern Home Cookin' just paid its annual

Q83: A project produces annual net income of

Q84: Treynor Industries is investing in a new

Q88: A "fallen angel" is a bond that

Q95: The average of a firm's cost of

Q109: The Stiller Corporation will pay a $3.80