Multiple Choice

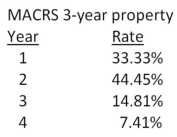

Peterborough Trucking just purchased some fixed assets that are classified as 3-year property for MACRS.The assets cost $10,600.What is the amount of the depreciation expense in year 3?

Definitions:

Related Questions

Q7: Which of the following statements is correct

Q22: Which one of the following will increase

Q71: Miller Mfg.is analyzing a proposed project.The company

Q73: What is the amount of the risk

Q78: Which of the following values will be

Q88: How does the net present value (NPV)

Q88: How much are you willing to pay

Q90: Theresa adds $1,500 to her savings account

Q93: Brubaker & Goss has received requests for

Q98: Which one of the following is a