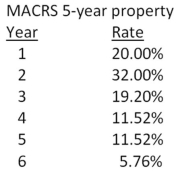

You own some equipment that you purchased 4 years ago at a cost of $225,000.The equipment is 5-year property for MACRS.You are considering selling the equipment today for $87,000.Which one of the following statements is correct if your tax rate is 35 percent?

Definitions:

IFRS

A collection of accounting norms formulated by the International Accounting Standards Board (IASB), known as International Financial Reporting Standards, which are increasingly being adopted worldwide for the creation of financial statements for public companies.

Development Expenditures

Costs incurred in the research and development of new products or services, which are often capitalized and amortized over time.

Expected Benefit Approach

A method used in accounting for pensions that allocates the cost of pensions over the years during which employees earn their pension benefits.

Discounted Present Value

A valuation method that calculates the current worth of a future cash flow, taking into account the time value of money.

Q6: The Pancake House has sales of $1,642,000,

Q16: A 16-year, 4.5 percent coupon bond pays

Q20: Your credit card company charges you 1.65

Q20: Which one of the following methods of

Q37: An agent who arranges a transaction between

Q57: Can the initial cash flow at time

Q65: Delta Lighting has 30,000 shares of common

Q70: Which one of the following is a

Q75: Holdup Bank has an issue of preferred

Q89: Morris Industries has a capital structure of