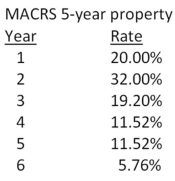

Edward's Manufactured Homes purchased some machinery 2 years ago for $319,000.These assets are classified as 5-year property for MACRS.The company is replacing this machinery today with newer machines that utilize the latest in technology.The old machines are being sold for $140,000 to a foreign firm for use in its production facility in South America.What is the aftertax salvage value from this sale if the tax rate is 35 percent?

Definitions:

Q17: Cantor's has been busy analyzing a new

Q43: Which one of the following represents the

Q44: As the degree of sensitivity of a

Q45: You just paid $750,000 for an annuity

Q81: Keyser Petroleum just purchased some equipment at

Q83: A project produces annual net income of

Q86: Which one of the following would make

Q93: Which one of the following is the

Q100: A floor broker on the NYSE does

Q100: An investment project provides cash flows of