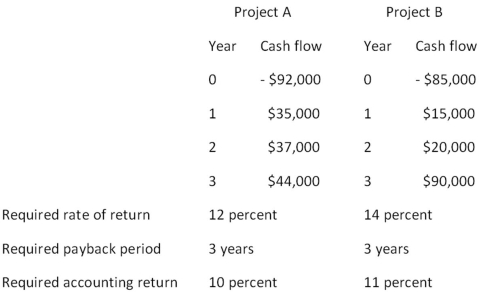

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on payback analysis?

Should you accept or reject these projects based on payback analysis?

Definitions:

Deferred Tax Liability

A tax obligation that arises when taxable income and accounting income differ, to be paid in future reporting periods.

Amortization

The process of gradually writing off the initial cost of an asset over a period. It's often used in the context of loan repayments or spreading the cost of an intangible asset over its useful life.

Accounts Payable

The amount a company owes to suppliers or vendors for goods or services received that have not yet been paid for.

Financial Statements

Documents that provide an overview of a company's financial condition, including balance sheet, income statement, and cash flow statement.

Q23: Consider the following information on Stocks I

Q29: You want to have $1.04 million in

Q37: Net present value:<br>A)is the best method of

Q39: Which one of the following is a

Q71: The owner of one of the 1,366

Q74: Which one of the following is a

Q76: Suppose you observe the following situation: <img

Q101: Callable bonds generally:<br>A)grant the bondholder the option

Q102: The person on the floor of the

Q124: Your credit card company quotes you a