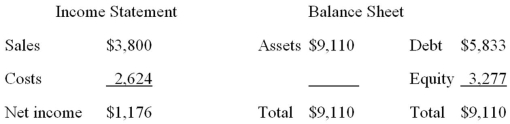

The most recent financial statements for Watchtower, Inc.are shown here (assuming no income taxes) :  Assets and costs are proportional to sales.Debt and equity are not.No dividends are paid.Next year's sales are projected to be $4,750.What is the amount of the external financing needed?

Assets and costs are proportional to sales.Debt and equity are not.No dividends are paid.Next year's sales are projected to be $4,750.What is the amount of the external financing needed?

Definitions:

Price Sensitive

Pertaining to stocks or securities that are highly responsive to changes or news in the market, affecting their price movements.

Zero-Coupon Bond

A debt security that does not pay interest (coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value.

Yield to Maturity

The total return anticipated on a bond if the bond is held until it matures, reflecting interest payments and price changes.

Price Yield Curve

A graph that shows the relationship between the yield of bonds and their maturities, illustrating how interest rates affect bond prices.

Q12: Which mineral deficiency would be suspected with

Q15: Cash flow from assets is also known

Q19: Lean tissue is less metabolically active than

Q40: Noncash items refer to:<br>A)accrued expenses.<br>B)inventory items purchased

Q47: Which symptom is very often the first

Q69: During any given day, when do people

Q76: You are considering two savings options.Both options

Q86: Recently, you discovered a putable income bond

Q94: The Corner Hardware has succeeded in increasing

Q126: Which of the following relationships apply to