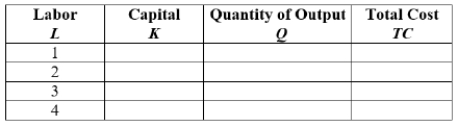

A firm with a production function Q = KL (where K is units of capital and L is units of labor) has an expansion path that is given by K = 2L. The wage rate (W) is $20 and the rental on capital is $10.  Assuming that the firm is using the optimal mix of inputs for any given output level, the quantity of output using three units of labor is ____.

Assuming that the firm is using the optimal mix of inputs for any given output level, the quantity of output using three units of labor is ____.

Definitions:

Risk-Free Rate

The theoretical rate of return of an investment with no risk of financial loss, typically associated with government bonds.

Market Risk Premium

The additional return an investor expects to receive from holding a risky market portfolio instead of risk-free securities.

Beta Coefficient

A measure of a stock's volatility in relation to the overall market, used in the Capital Asset Pricing Model to determine the expected return of the asset.

Systematic Risk

The danger that affects the whole market or a specific segment of the market, commonly referred to as market risk.

Q1: PROBLEM DATA <br>Ranger Industries has provided the

Q2: For each exercise, enter the following on

Q2: PROBLEM DATA <br>The records of Anderjak Corporation

Q42: Suppose that a firm's production function is

Q88: A monopolist with a marginal cost of

Q93: Suppose a firm's total cost curve is

Q113: (Figure: Natural Monopolist I) If the government

Q115: (Table: Level of Output I) The level

Q117: Suppose the production function for a coffee

Q121: (Figure: Good Y and Good X VI)