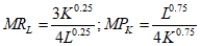

Suppose a firm with a production function given by Q = K0.25L0.75 produces 1,500 units of output. The firm pays a wage of $50 per unit and pays a rental rate of capital of $50 per unit.

(Note:

)

To minimize the cost of producing 1,500 units of output, the firm should use:

Definitions:

Discount Rate

The interest rate charged by central banks for lending money to commercial banks or the rate used in discounted cash flow analysis to determine the present value of future cash flows.

Project Profitability Index

A financial metric that calculates the ratio between the present value of future cash flows and the initial investment of the project.

Profitability Index

A financial metric that measures the relative profitability of an investment, calculated as the present value of future cash flows divided by the initial investment cost.

Investment Projects

Initiatives undertaken by companies or individuals to allocate capital in ways expected to yield returns or gains over time, such as purchasing new equipment or expanding operations.

Q11: The utility function for Raj is U

Q17: Yasmine has $40 weekly to spend on

Q18: Meera operates Ducks Unlimited, which raises mallard

Q30: Consumer surplus can be calculated as:<br>A) <img

Q35: If TC = 1,500 + 7.5Q +

Q36: (Figure: Capital and Labor IV) Which of

Q51: Consider the following table for a monopolist

Q71: A perfectly competitive industry has 100 high-cost

Q120: A firm's demand curve is given by

Q147: In market A, a firm with market