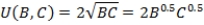

Suppose that Bella's utility function from bananas (B) and chocolate (C) is  . Her budget is $15, and the price of chocolate is $3.

. Her budget is $15, and the price of chocolate is $3.

Bella's demand for bananas is ____.

Definitions:

Lease-Purchase Analysis

Lease-Purchase Analysis is a financial evaluation to determine whether leasing or purchasing an asset is more cost-effective in the long term.

After-Tax Borrowing Rate

The interest rate on loans after taking into account the tax deductions on interest payments, affecting the net cost of borrowing.

Discount Rate

The interest rate used to determine the present value of future cash flows in discounted cash flow analysis.

Leveraged Lease

A financing agreement where a lessor borrows funds to purchase an asset, which is then leased to a lessee, with the lease payments ensuring repayment of the loan.

Q2: Siti is one of many consumers in

Q6: The demand for a good is given

Q17: Consider the production function Q = Af(K,

Q23: Many U.S. states have minimum price laws

Q28: Suppose the firm's production function is Q

Q88: The market for good X consists of

Q103: (Figure: Average Total Cost and Quantity of

Q106: A consumer's bundle includes good X and

Q109: In the lemonade stand industry, Lucia is

Q133: All else being equal, a demand increase:<br>A)