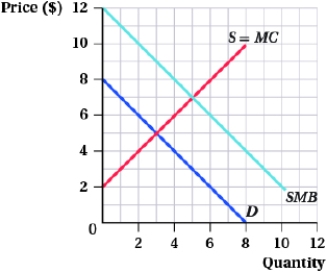

(Figure: Marginal Benefit I) Which of the following statements is (are) TRUE?  I. The external marginal benefit is $7.

I. The external marginal benefit is $7.

II) The socially optimal price is $5.

III) At an output level of 5 units, the deadweight loss is $6.

IV) At 8 units of output, there is no private marginal benefit and social marginal benefit is $4.

Definitions:

Net Present Value

Net Present Value (NPV) is a financial metric that calculates the value of a series of cash flows over time, discounted back to their present value to assess an investment's profitability.

Desired Rate of Return

The minimum return a company or investor expects to achieve on an investment, often used in capital budgeting to evaluate potential projects.

Future Cash Flows

The projected inflows and outflows of cash over a specific future period, vital for financial planning and valuing investments.

Capital Investment Analysis

Capital investment analysis is the process of evaluating the potential returns of an investment in fixed assets, considering factors such as cost, life expectancy, and the benefits it will provide.

Q3: Yesterday, Melinda bought a ticket for today's

Q13: Suppose that a publisher is considering how

Q36: Suppose a person prefers $100 today to

Q37: A corporate bond has a $10,000 face

Q65: Suppose the demand curve for steel is

Q72: Suppose that the market demand curve for

Q72: The _ problem occurs when consumers want

Q111: The following companies all manufacture widgets and

Q113: The marginal cost of pollution is MC

Q116: Suppose that the demand curve for a