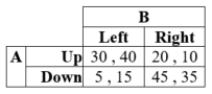

Suppose the payoffs for players A and B, given their respective strategies, are as in the table:  There is a mixed-strategy Nash equilibrium when Player A chooses Up with probability ____.

There is a mixed-strategy Nash equilibrium when Player A chooses Up with probability ____.

Definitions:

Dynamic Hedging

A strategy that involves adjusting the hedge position dynamically as market conditions change, used to manage risk in trading portfolios.

Static Hedging

A financial strategy that involves setting up a position in options or other securities to mitigate risk, without needing to adjust the position frequently.

Capital Outlay

The amount of money spent on acquiring or improving fixed assets, such as buildings, equipment, and land.

Black-Scholes Option-pricing Model

A mathematical model for pricing European call and put options, using factors like the stock's price, exercise price, risk-free rate, and time to expiration.

Q20: (Figure: Game A and B I) <img

Q34: (Table: Firms A and B I) The

Q38: A movie theater faces the following hourly

Q87: Consider two players in the following game.

Q90: The _ model is an example of

Q93: A monopsony has a marginal revenue product

Q99: Suppose that Etsy (an e-commerce site focused

Q116: What is the option value of waiting?<br>A)

Q138: Which of the following is an example

Q161: The price elasticity of demand for coffee