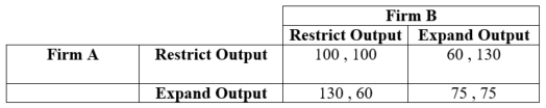

(Table: Firms A and B X) Two firms have formed an agreement to restrict output.  They are playing an infinitely repeated game in which output decisions must be made every period. Both firms are using grim trigger strategies.

They are playing an infinitely repeated game in which output decisions must be made every period. Both firms are using grim trigger strategies.

If d (discount rate) = 0.80, Firm B's expected payoff from cheating on the agreement is ____.

Definitions:

Boeing

A global American corporation engaged in designing, manufacturing, and selling airplanes, rotorcraft, rockets, satellites, missiles, and telecommunications equipment around the world.

Random Walk

A theory suggesting that the price movements of securities are unpredictable and random, making it impossible to consistently predict their future movements based on past trends.

Stock Prices

The current market price at which a share of a company is bought or sold.

Price Changes

Adjustments in the price levels of goods, services, or securities in the market.

Q5: Assume you are a manufacturer of small

Q6: (Table: Car Dealerships I)<br>Payoffs: Anastasia's Monthly Profit,

Q23: The market inverse demand curve is P

Q36: For the case of a perfectly price-discriminating

Q43: Two companies are the only snowplow merchants

Q66: The inverse demand for tacos is given

Q67: The real interest rate is the rate:<br>A)

Q87: Consider two players in the following game.

Q101: (Table: Hotel Stay and Airfare I) The

Q126: In a Cournot market structure, each firm's