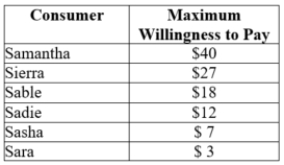

(Table: MLB.TV Subscription I) The table shows each consumer's maximum willingness to pay for a monthly subscription to MLB.TV (Major League Baseball Television) .  Each consumer is interested in purchasing a single subscription per month. The marginal cost of a subscription is $10. If MLB.TV can practice first-degree price discrimination, how much producer surplus will it earn from these consumers?

Each consumer is interested in purchasing a single subscription per month. The marginal cost of a subscription is $10. If MLB.TV can practice first-degree price discrimination, how much producer surplus will it earn from these consumers?

Definitions:

Payroll Tax Expense

This refers to the taxes that an employer is responsible for paying on behalf of its employees, which generally include social security and Medicare taxes.

FICA Taxes Payable

Taxes owed by an employer, employee, or both, to the Federal Insurance Contributions Act for Social Security and Medicare.

Employer's Payroll Taxes

Taxes that an employer must pay based on the wages and salaries of its employees, which can include Social Security taxes, Medicare taxes, and unemployment taxes.

Medicare Tax Rate

The percentage of an individual's earnings that is deducted to fund the Medicare program, as specified by federal law.

Q2: Discuss the problems of trading off exploration

Q7: Executives at Warner Brothers believe that Ellen

Q7: Choose one of the cases from the

Q45: The table contains letters that represent payoff

Q107: The muscles allowing for forearm extension are

Q117: Answer the following questions.<br>a. What is backward

Q118: The graph depicts a monopolistically competitive firm

Q131: (Table: Players A and B III) The

Q150: (Table: Jack and Jill I) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8428/.jpg"

Q161: (Table: Detroit Art School and Motor City