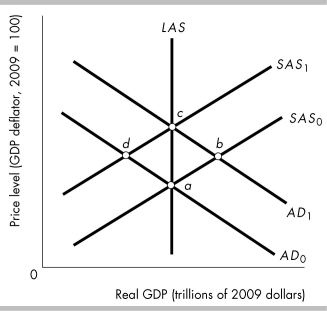

-In the above figure, if the economy is initially at point c, the short-run effect of a hike in the federal funds rate is given by movement from point

Definitions:

Non-Eligible Dividends

Dividends that are paid out from earnings that have not been taxed at the corporate level, often subject to different tax treatment at the recipient's level.

Capital Gains

The profit realized from the sale of assets such as stocks, bonds, or real estate, when the selling price exceeds the purchase price.

Marginal Tax Rates

The rate at which the last dollar of income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Total Tax

Total tax refers to the combined amount of all taxes owed by an individual or business entity in a given tax period, including federal, state, and local taxes.

Q35: Economic data for a mythical economy in

Q54: Suppose a factory can be designed to

Q68: Looking at the supply-side effects on aggregate

Q98: If the government runs a deficit, the

Q120: The largest source of government revenues is<br>A)

Q137: If we compare the United States to

Q166: An import quota is a<br>A) tariff imposed

Q191: A tariff hurts<br>A) the government by decreasing

Q233: The supply side effects of a cut

Q378: "If Mexico is currently operating at a