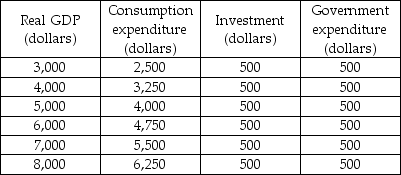

-In the above table, there are no taxes and no imports or exports. Investment increases from $500 to $750. After the increase in investment, the new equilibrium level of output is

Definitions:

Per-Unit Tax

A tax imposed on a product based on a fixed amount for each unit sold, affecting the supply curve by increasing the cost of production.

Units Sold

The number of individual items or products that have been sold over a specific period.

Elasticity

A measure of how much the quantity demanded or supplied of a good or service changes in response to price or other factors.

Tax Burden

Refers to the economic impact of taxes on an individual, corporation, or market, often measured as a percentage of income or GDP.

Q7: Which of the following is TRUE about

Q48: Which of the following is TRUE?<br>A) MPS

Q60: An increase in _ shifts the AE

Q67: The U.S. exchange rate rises. As a

Q71: A rational expectation is<br>A) a forecast devoid

Q245: The short-run aggregate supply curve shifts leftward

Q257: In the above figure, suppose the economy

Q298: The long-run aggregate supply curve is the

Q383: Suppose the equilibrium level of expenditure is

Q393: In the above figure, which part corresponds