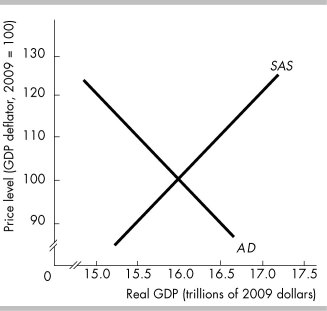

-Use the figure above to answer this question. At a price level of 90

Definitions:

Face Value

The nominal or original value printed on a security or financial instrument, such as a bond or stock certificate, indicating its worth at issuance.

Coupon Rate

The yearly interest yield on a bond, shown as a percentage of its nominal value, disbursed from the date of issuance to the date it matures.

Present Value

A calculation that determines the current value of an amount of money to be received in the future, discounted at a specific interest rate.

Yield To Maturity

Yield to maturity is the total return expected on a bond if the bond is held until it matures, including all interest payments and the repayment of par value.

Q16: From 8 P.M. to 10 P.M., Susan

Q56: An inflationary gap means that the level

Q110: The Federal Reserve lowers interest rates. As

Q114: An increase in investment spending results in

Q147: Which of the following statements is CORRECT?<br>A)

Q154: Based on the data in the table

Q214: What is the relationship between the aggregate

Q235: Explain whether the statement, "Hillary Clinton was

Q252: The short-run aggregate supply curve<br>A) shows what

Q443: "The global financial crisis has had a